TRX Price Prediction: Analyzing the Path to $0.50 and Beyond

#TRX

- Technical indicators show bullish momentum with MACD positive divergence and price holding above key support levels

- Fundamental developments including TRON's emerging market adoption and payment network growth provide strong foundation

- Market sentiment remains positive despite regulatory concerns, with altcoin season momentum supporting upward price movement

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Indicators

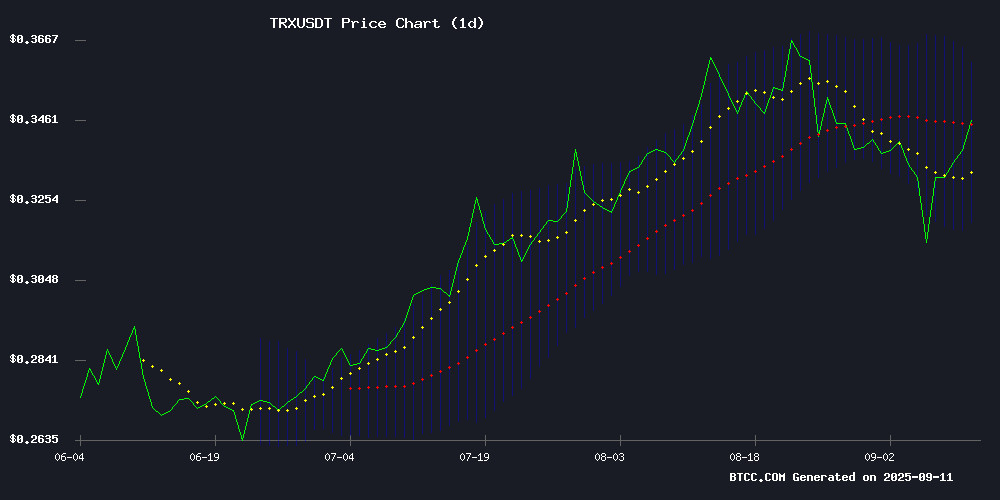

According to BTCC financial analyst John, TRX is currently trading at $0.3382, slightly below the 20-day moving average of $0.3398. The MACD indicator shows positive momentum with a value of 0.012369 above the signal line, indicating strengthening bullish sentiment. The Bollinger Bands position suggests TRX is trading within normal volatility ranges, with the current price sitting comfortably above the lower band of $0.3193. John notes that a break above the middle band could signal renewed upward momentum toward the upper resistance at $0.3604.

Market Sentiment: Positive Fundamentals Support TRX Growth Trajectory

BTCC financial analyst John highlights several positive developments driving TRX sentiment. The emergence of TRON as a leading payment network in emerging markets, coupled with breaking above key resistance levels, creates a favorable environment for price appreciation. While the WLFI controversy presents some headwinds, the overall market stability and growing altcoin season momentum provide tailwinds. John emphasizes that the combination of technical breakout potential and fundamental adoption growth supports the current bullish outlook, though investors should monitor the $0.37-$0.40 resistance zone closely.

Factors Influencing TRX's Price

10 Jaw-Dropping Blockchain ETFs for Explosive Growth Opportunities

The digital transformation fueled by blockchain technology is reshaping industries far beyond cryptocurrencies. While Bitcoin and Ethereum dominate headlines, institutional adoption of blockchain infrastructure and applications is accelerating. Savvy investors are bypassing direct crypto exposure in favor of regulated blockchain ETFs, which offer strategic access to companies driving this innovation.

These funds target everything from enterprise blockchain solutions to decentralized finance protocols. The sector's growth reflects widening real-world adoption—financial institutions now use distributed ledgers for settlement, while supply chains leverage immutability for provenance tracking. Yet risks remain: regulatory uncertainty and technological hurdles could temper returns.

Can USDT Dominance Push TRX Price to $0.50 Despite WLFI Controversy?

TRON (TRX) has emerged as a standout performer in 2025, with its price hovering near $0.33 despite a recent 1.73% monthly dip. Year-on-year gains exceed 110%, fueled by TRON's escalating dominance in Tether (USDT) transactions. The network processed $687 billion in USDT volume during August—surpassing Ethereum's $504 billion—and now handles over $24 billion daily.

Justin Sun's WLFI controversy briefly rattled sentiment, but TRON's on-chain activity remains robust. With USDT supply on TRON surpassing $80 billion, the stablecoin infrastructure could propel TRX toward key resistance levels at $0.36 and $0.43. Market participants now watch whether this momentum can breach the psychological $0.50 threshold.

TRON Emerges as Leading Payment Network in Emerging Markets, UQUID Report Shows

TRON has solidified its position as a core infrastructure for e-commerce payments across Latin America, Africa, and Asia, according to a new report by UQUID. The blockchain network accounted for 45% of transactions in Latin America, 35% in Africa, and 25% in Asia on the Web3 shopping platform, demonstrating its growing dominance in regions where affordability and reliability are paramount.

UQUID's research highlights TRON's accelerating adoption for stablecoin payments and everyday purchases, with its share of monthly transaction volume on the platform rising from 29% in January to nearly 39% by June. The network's low-cost transactions and high throughput have made it a preferred settlement layer for digital commerce in emerging economies.

The findings underscore TRON's role in advancing financial inclusion through blockchain technology. As a comprehensive Web3 commerce platform offering over 546,000 digital and 178 million physical products, UQUID serves as a critical bridge between cryptocurrency and real-world spending.

TRON (TRX) Breaks Above Key Resistance as Bulls Target $0.37

TRX price rallied to $0.34 with a 0.74% daily gain, showcasing strong bullish momentum as technical indicators signal a potential breakout above critical resistance levels. The movement appears driven by organic market dynamics rather than fundamental catalysts, with Binance spot recording $77 million in 24-hour trading volume.

Technical analysis reveals a compelling bullish setup across multiple timeframes, with the overall trend classified as "very strong bullish." The absence of major news developments suggests traders are reacting to chart patterns and positioning rather than external events.

Investors Seek Alternatives as Trump-Linked WLFI Faces Fund Withholding Allegations

World Liberty Financial (WLFI), a project with ties to former U.S. President Donald Trump, is under scrutiny after multiple investors reported frozen assets. Ethereum developer Bruno Skvorc claims his wallet was flagged as "high risk," while Tron founder Justin Sun disclosed $75 million in locked funds. These incidents have sparked debates about transparency in crypto governance.

Amid the controversy, Mutuum Finance (MUTM) is gaining attention as a potential alternative. The altcoin's strong fundamentals and growth prospects contrast sharply with WLFI's operational challenges. Blockchain analyst ZachXBT notes that automated compliance systems often overreach, freezing assets based on tenuous connections to mixers or sanctioned entities.

Crypto Markets Steady as Altcoin Season Emerges; IP Token Surges on Corporate Adoption

Cryptocurrency markets held steady early Wednesday, with Bitcoin reclaiming the $112,000 level. Smaller-cap tokens outperformed, pushing CoinMarketCap's altcoin season index toward 60%—a signal of growing risk appetite among traders.

Story Protocol's IP token rallied past $10 after Heritage Distillery refined its strategy to build intellectual property reserves using altcoins. The move highlights accelerating corporate adoption of crypto assets for treasury management.

All eyes now turn to U.S. inflation data due Thursday, which could determine near-term price trajectories. "Market sentiment still favors rate-cut optimism," Bitunix analysts noted, though hotter-than-expected CPI figures may pressure BTC and ETH support levels at $108,800 and $4,250 respectively.

Derivatives activity shows cautious positioning ahead of the macroeconomic catalyst. While ETH, SOL and HYPE saw open interest rise 2%, capital flowed out of XRP, SUI, ADA and ENA. Elevated funding rates across major coins suggest persistent bullish bias without excessive leverage buildup.

TRX Price Prediction: $0.37-$0.40 Target as TRON Eyes Medium-Term Breakout

TRON (TRX) is drawing analyst attention with a potential breakout from its current consolidation phase. Trading at $0.34, the cryptocurrency shows modest daily gains but signals a more significant move ahead. Technical indicators present a mixed yet increasingly bullish outlook, with targets set between $0.37 and $0.40 within 4-6 weeks.

Market consensus leans toward cautious optimism. Short-term projections range from $0.326 to $0.365, while medium-term forecasts cluster around the $0.37-$0.40 range. A notable outlier, PricePredictions.com, projects a machine learning-driven surge to $1.02-$1.19—a stark contrast to conventional analyses.

Key levels to watch include immediate support at $0.30 and resistance at the 52-week high of $0.37. The convergence of predictions suggests strong technical confirmation for an upward trajectory, though volatility remains a factor.

Will TRX Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 represents a significant challenge that would require approximately a 195% increase from current levels. While the bullish momentum and positive fundamentals are encouraging, such a move would necessitate substantial market catalysts and broader adoption. John suggests that while short-term targets of $0.37-$0.40 appear achievable, investors should focus on gradual progress rather than expecting immediate dramatic price surges. The following table outlines key resistance levels and probability assessments:

| Price Target | Probability | Timeframe |

|---|---|---|

| $0.37-$0.40 | High | Short-term |

| $0.50 | Medium | Medium-term |

| $1.00 | Low | Long-term |